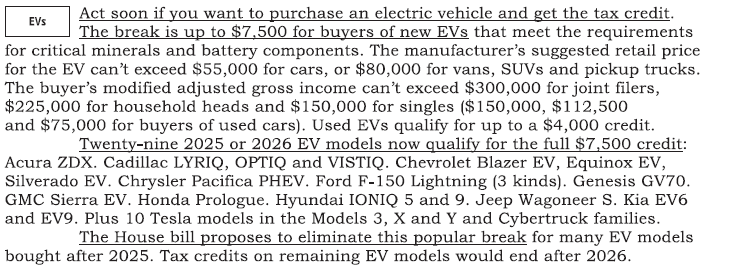

I read the following helpful information on EV tax credits in the tax letter I subscribe to:

Source: The Kiplinger Tax Letter 5/22/2025

I read the following helpful information on EV tax credits in the tax letter I subscribe to:

Source: The Kiplinger Tax Letter 5/22/2025

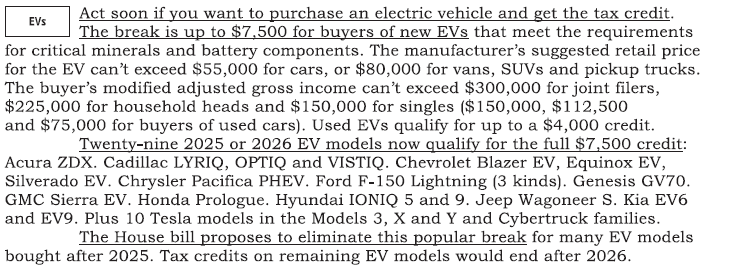

This chart I printed from a class I took is very helpful in determining your RMD age:

Installment Agreement Requests – If you owe taxes and cannot pay right away, these are the links for the forms to request installment agreements:

NY Payment Plan Request – See below from their website:

To make your request online:

Please see information below from the IRS about the Self-Employed Health Insurance Deduction:

The insurance plan must be established, or considered to be established, as discussed in the following bullets, under your business.

See Instructions for Form 7206 (2024) | Internal Revenue Service

Below is information from the NY Department of Taxation and Finance about the STAR program for NY Homeowners. See STAR resource center

The School Tax Relief (STAR) program offers property tax relief to eligible New York State homeowners.

If you are eligible and enrolled in the STAR program, you’ll receive your benefit each year in one of two ways:

Please go to STAR resource center to register.

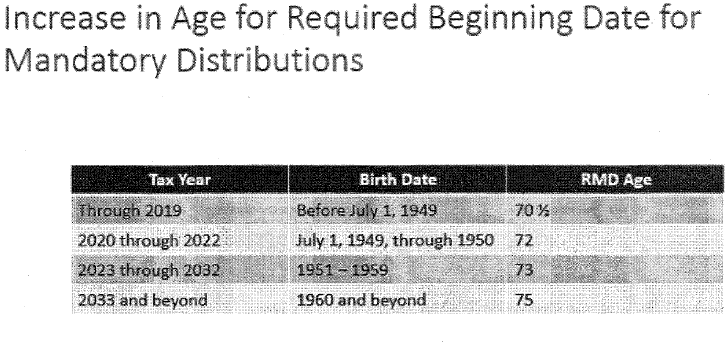

The Reporting Rule requires certain entities to file beneficial ownership information (BOI)

reports (referenced in this Guide as BOI reports or reports) to FinCEN. See BOI Small Compliance Guide v1.1 (fincen.gov) for more information. Below is some helpful deadline info.

This is a good article on Roth 401ks from Kiplinger Retirement. I invest in Roth 401k and Roth IRAs. It avoids a tax bill on the investments and gains in your retirement accounts when you begin making distributions at retirement.

If you hire a new employee that has been unemployed for 27 weeks or more and received unemployment benefits, there is a 40% credit on the first $6,000 in wages called the Work Opportunity Tax Credit. Something to think about when hiring someone new and they tell you they have been out of work for more than 6 months.

The deadline for buying health insurance on an exchange for 2016 is January 31, 2016. Without health insurance coverage, the IRS penalizes you. Please see https://www.healthcare.gov/fees/fee-for-not-being-covered/ for more information on the penalties involved.

1. Coping with Overlooked College Expenses

2. Post-Retirement Work and the Impact on Social Security, Taxes and Health Care

3. Job Search Expenses May be Deductible

4. Tax Credits That Can Help Lower College Costs

5. The Tax Effects of Divorce or Separation

6. Tax Considerations (and Advantages)

===========================================================

1. COPING WITH OVERLOOKED COLLEGE EXPENSES

You know college is going to cost a lot, but are you sure you know exactly how much? Here are some of the unexpected charges you should anticipate and advice on ways to deal with them. https://www.njcpa.org/stay-informed/tax-financial/full-article/2015/08/26/coping-with-overlooked-college-expenses

============================================================

2. POST-RETIREMENT WORK AND THE IMPACT ON SOCIAL SECURITY, TAXES AND HEALTH CARE

Individuals thinking about returning to the workforce after retiring need to learn if and how Social Security benefits, health insurance and taxes will be affected so that they don’t lose benefits or end up in a higher tax bracket. https://www.njcpa.org/stay-informed/tax-financial/full-article/2015/08/26/post-retirement-work-and-the-impact-on-social-security-taxes-and-health-care

============================================================

3.

JOB SEARCH EXPENSES MAY BE DEDUCTIBLE

If you look for a job in the same line of work, you may be able to deduct some of your job search costs. Here are some key tax facts you should know about if you search for a new job. https://www.njcpa.org/stay-informed/tax-financial/full-article/2015/08/28/job-search-expenses-may-be-deductible

============================================================

4. TAX CREDITS THAT CAN HELP LOWER COLLEGE COSTS

Are you looking for ways to minimize the costs of higher education? There are some tax laws that can help lower your outlays. https://www.njcpa.org/stay-informed/tax-financial/full-article/2015/08/26/tax-credits-that-can-help-lower-college-costs

============================================================

5. THE TAX EFFECTS OF DIVORCE OR SEPARATION

Income tax may be the last thing on your mind after a divorce or separation. However, these events can have a big impact on your taxes. Here are some key tax tips to keep in mind if you get divorced or separated. https://www.njcpa.org/stay-informed/tax-financial/full-article/2015/08/24/the-tax-effects-of-divorce-or-separation

============================================================

6. TAX CONSIDERATIONS (AND ADVANTAGES) FOR SMALL BUSINESSES

Are you thinking of launching your own business? It’s critical to understand the many rules and regulations that apply to you. https://www.njcpa.org/stay-informed/tax-financial/full-article/2015/08/26/tax-considerations-(and-advantages)-for-small-businesses

============================================================

Good news for those who are blind or disabled. The States received approval the IRS to offer ABLE accounts. Nondeductible contributions of up to $14,000 per year can be made for

a person who became blind or disabled before age 26. Distributions are tax-free if used for housing, transportation, education, job training and similar expenses.

This is a good tool to use in calculating Required Minimum Distributions: http://apps.finra.org/Calcs/1/RMD

Governor Chris Christie has provided additional time for senior and disabled residents to access property tax relief benefits by extending the filing deadline for applications for the 2014 Senior Freeze (Property Tax Reimbursement Program) to October 15, 2015.

State and federal laws require that all employers report new and re-hired employees to a statewide directory within 20 days. The site for NJ is nj-newhire.com. For NY it is www.nynewhire.com.

If you receive a call from the IRS, it is probably a scam. First call the IRS at 1-800-366-4484 to confirm whether the caller is an employee of the IRS. If they are not an employee, you can file a complaint at the following link: http://www.treasury.gov/tigta/contact_report_scam.shtml

You have until February 15th to sign up for an individual policy for 2015 on the health care exchanges. Please go to healthcare.gov if you are living in New Jersey since there is no New Jersey exchange. If you are living in New York, please use the following link for the New York exchange: nystateofhealth.ny.gov

Medicare open enrollment is from October 15th until December 7th for 2015 plans. For those already on Medicare, it is a good time to review alternative plans. A good website to find Part D or Advantage plan options is https://www.medicare.gov/find-a-plan.

Estates have until December 31 to elect portability so that the unused estate and gift tax exemption passes to the surviving spouse. Please contact me if you would like to discuss further.

Don’t fall for callers claiming to be the IRS and saying you owe more taxes. The IRS never makes calls to tell taxpayers they owe more in taxes. Please call 800-366-4484 if you receive a bogus call.

Due to last year’s 16 day government shutdown, the IRS will not be processing 2013 personal returns until January 31st. The IRS started accepting business returns on January 13th.

The 2013 standard mileage rate is 56.5 cents per mile for business driving. It decreases to 56 cents per mile in 2014.

This is a good resource to help look for errors in 401(K) plans:

http://www.kiplinger.com/members/links/ktl/131220/401k_fixit_guide.pdf#!

The Supreme Court is moving closer to deciding on whether severance pay for laid off workers is subject to FICA tax. It will probably be decided in the spring.

If you want to see how your 401K plan ranks, please see the following link: BrightScope.com

This is a good tool to estimate what you will need to save every month for retirement: www.wellsfargo.com/myretirementplan You will need a Wells Fargo account to open the tool.

The IRS has launched a new and helpful Affordable Care Act tax provisions website to educate individuals and businesses. Please see http://irs.gov/aca

This is a good calculator to see if you qualify for a tax credit under the new healthcare law: www.turbotax.intuit.com/health-care

The following link has a great tool to see how different states tax retirees: http://kiplinger.com/tools/retiree_map

Under the Affordable Care Act, taxpayers will be able to get a credit to help them buy health insurance. To get the credit, household income must be between 100% and 400% of the federal poverty level. This is currently $11,490 to $45,960 for singles and $23,550 to $94,200 for a family of four. People who are eligible for Medicare or other federal insurance do not qualify for the credit.

Effective January 1, 2014, individuals must have minimum essential health insurance coverage for themselves and their dependents to avoid a tax. This includes coverage provided by employers that meet minimum federal requirements, coverage through an exchange and federal coverage such as Medicare, Medicaid, Tricare and veterans coverage. Please contact me if you would like to discuss further.

Donations to foreign charities are not deductible. Only donations to charities established under U.S. law can be deducted.

This is an interesting site to see if a state treasury has unclaimed assets in your name: missingmoney.com The search is free.

The Supreme Court has struck down the Defense of Marriage Act. Couples who get married in the District of Columbia or in the 13 states that allow same-sex marriage can now file federal income tax returns jointly. Estate planning will also be easier. Please contact me if you would like to discuss further.

Here are the links for the Health Insurance Marketplace Standard Consumer Application from cms.gov: -Individual Short Form http://www.cms.gov/CCIIO/Resources/Forms-Reports-and-Other-Resources/Downloads/marketplace-app-short-form.pdf -Family http://www.cms.gov/CCIIO/Resources/Forms-Reports-and-Other-Resources/Downloads/marketplace-app-standard.pdf -Individual without Financial Assistance http://www.cms.gov/CCIIO/Resources/Forms-Reports-and-Other-Resources/Downloads/marketplace-app-no-financial-assistance.pdf

October 1st, 2013 is open enrollment for the new state-based health insurance marketplace (exchanges) created under the 2010 health care overhaul law. The following link is helpful to see where states stand: http://kff.org/state-health-exchange-profiles/

For social security benefits, you have 12 months after first claiming benefits to file and have the application withdrawn. This way you can restart benefits later at a higher benefit amount. Please contact me if you would like to discuss further.

Treasury Form 90-22.1 (FBAR) is required to be filed if you have an interest in foreign accounts totaling more than $10,000 at any time during the year. This form is filed separately from your income tax returns. For 2013, it must be e-filed and is due June 30, 2014. Please contact me if you would like to discuss further.

For Real Estate Professionals, in order to deduct rental losses in full, you are required to spend over half your working hours and at least 750 hours per year materially involved in real estate. Please contact me if you want to discuss further.

The attached chart is an excellent resource from The Kiplinger Tax Letter. It highlights the type of retirement distributions and whether they are an exception to the 10% additional tax. Please contact me if you would like to discuss further.

For divorced parents, the noncustodial parent needs IRS Form 8332 signed by the custodial parent in order to claim children as dependents. Please contact me if you would like to discuss further.

If you filed or paid your taxes late, you may be qualified to have the IRS abate your penalty under its First Time Abate Program. You must be tax-compliant for the past 3 years. Please contact me for further information.

The social security wage base is increasing. The following are the estimates for the upcoming years: 2014 $115,800 2015 119,100 2016 123,600 2017 128,700

Some good news for Hurricane Sandy victims: The storm damage losses can be claimed on your 2011 or 2012 tax returns, whichever saves more money. Taxpayers have until October 15, 2013 to amend their 2011 returns to claim the storm damage losses. Unfortunately, NJ provides no tax benefit for the losses. Please contact me if you would like to discuss further.

For 2013, the AMT Exemptions increase to $80,750 for couples and $51,900 for singles and head of households.

The American Taxpayer Relief Act of 2012, signed January 1, 2013, did not extend the 4.2% employee social security tax. Effective 1/1/13, the employee social security tax increases from 4.2% to 6.2% for wages up to $113,700. This applies to self-employeds as well.

The taxpayer may deduct Medicare premiums paid on the front page of the 1040 if they are self-employed. Medicare premiums paid by a spouse do not count as self-employed medical insurance, deductible on the front page of the 1040, unless the spouse is also self-employed.

For gifts made by check, be sure the donee deposits it in 2012 if you want the money to count as a 2012 gift for gift tax purposes. Alternatively, deliver a certified check to the recipient this year, which will count as a 2012 gift. The 2012 annual gift exclusion is $13,000 per donee and for 2013, the annual gift tax exclusion is $14,000.

Check the balance in your flexible spending account. You must clean it out by December 31 if your employer still has not implemented the 2 1/2 month grace period that the IRS now permits. Otherwise, any money remaining in your account is forfeited. Also, for 2013, a $2,500 annual ceiling on heath flexible spending account payins goes into effect.

I recently read an article from Kiplinger about debt resolution fees. In this case, the debt resolution company saved a debtor $6,753. The tax court allowed him to deduct the $2,343 fee paid to the debt resolution company subject to the 2% limitation for miscellaneous itemized deductions.

Unter this IRS program, for many who file late or pay late, the IRS will OK a one-time waiver of the late payment and late filing penalties. The taxpayer must request relief and must be tax compliant for the past three years.

You have until 10/15/12 to undo a 2011 Roth conversion. If you filed your 2011 returns already, an amended return will have to be prepared to recover the taxes paid on the original conversion. Please contact me to find out more.

Worker’s compensation paid in lieu of Social Security benefits is taxable. An injured worker received both worker’s compensation and Social Security disability benefits. The worker’s compensation payments offset the social security benefits dollar for dollar. The worker’s compensation payment is treated just like other social security benefits: Up to 85% of the payments can be hit with income tax.

Severence payments for laid-off employees aren’t subject to FICA taxes according to an Appeal Court decision (Quality Stores, 6th Cir.). However, the IRS may appeal this decision to the Supreme Court.

Interesting tax break for Tenant-Owners of housing co-ops that do not own the land the building is on: Tenant-Owners can deduct their share of the building’s real estate taxes even though the land is leased from the owner and the Co-op constructed the building on leased land.

The 60 day rollover rule won’t apply if you inherit an IRA and the funds are first paid to you. The funds have to be transferred directly to IRA. Otherwise, the distribution is taxable.

You can deduct medicare premiums paid as health insurance on the front page of a 1040 (above-the-line) if you are a sole proprietorship, a partner in a partnership, or an S-Corporation 2%+ Shareholder.

The projected Social Security Base is as follows: 2013 $113,700 2014 $117,900 2015 $123,000 2016 $128,400

Only loans by shareholders to S-Corporations can increase their basis. Owners of S-Corporations can deduct losses only up to the amount of their investment in the company, including loans they make to the corporation. The debt must bona fide debt of the S corporation owed directly to the shareholder. Guarantors of loans to an S-Corporation do not get this break.

Congress should act soon regarding estate taxes. After 2012 if congress doesn’t act, the rules before 2001 will go into effect and the current $5.12 million estate and gift tax exemption will fall to $1 million. The maximum tax rate would also increase 20 percentage points to 55%.

Having incomplete substantiation of donations when filing nixes a deduction for the contributions, according to the Tax Court. A couple made regular gifts of $250 or more to the church that they belonged to. However, the acknowledgment from the church failed to state that no goods or services were given for the donations. After the Service denied their write-off because of the faulty acknowledgment, they got a letter from the church saying they received no benefits for the contributions. But that came far too late. The deduction was properly denied because the donors didn’t have valid substantiation in hand before filing (Durden, TC Memo. 2012-140).

The following items may cause a potentially higher risk for audit

1.Making too much money

2. Failing to report all taxable income

3. Taking large charitable deductions

4. Claiming the home office deduction

5. Claiming rental losses

6. Deducting business meals, travel and entertainment

7. Claiming 100% business use of vehicle

8. Writing off a hobby loss

9. Running a cash business

10. Failing to report a foreign bank account

11. Engaging in currency transactions

12. Taking higher than average deduction

Please contact me to discuss further